The Battery Report 2023

Co-authored By: Charlie Parker | Published on January 22, 2024

This report summarizes the most significant developments in the battery industry. Crowd-sourced from top industry and academia experts, this report seeks to provide a comprehensive and accessible overview of the latest battery research, policy, and business landscape.

|

Scale and the Economic Mechanisms of Learning Rate: Applying Lessons From Solar to the Battery Industry

Co-authored By: Charlie Parker | Published on July 25, 2023

|

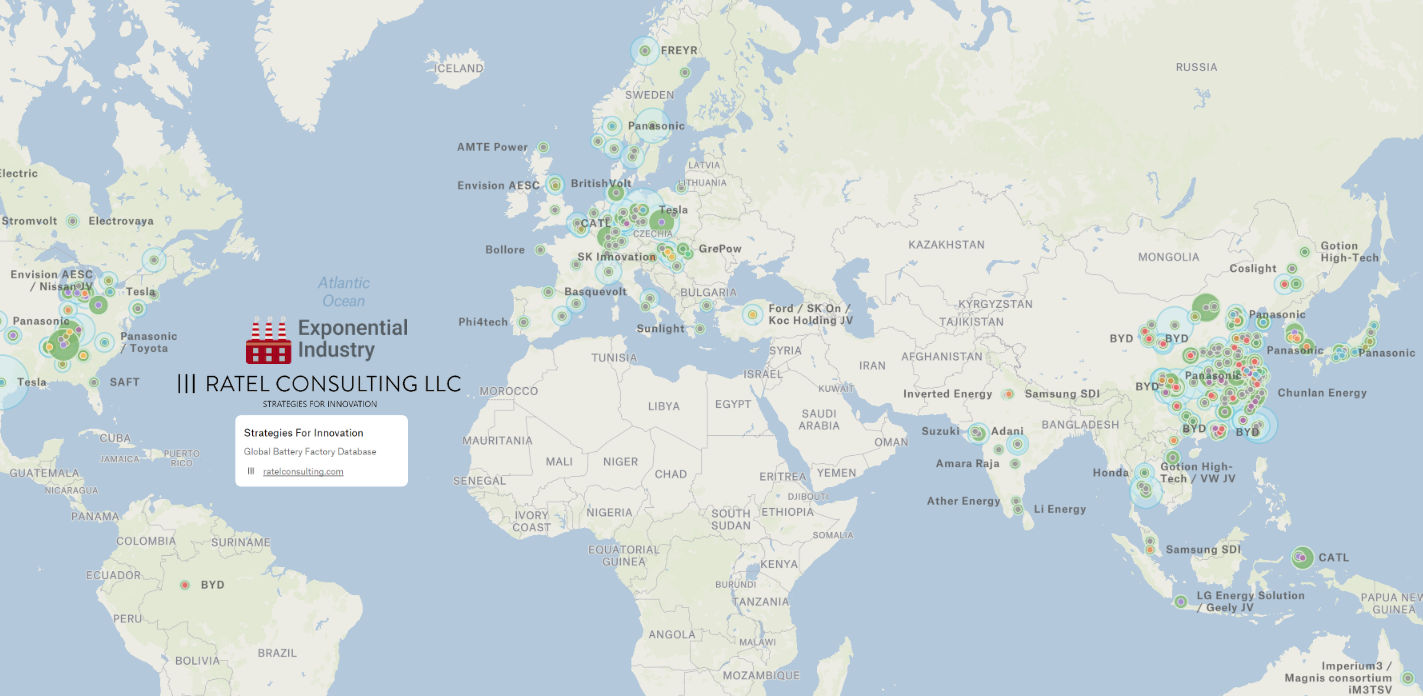

Global Battery Factory Database

Contributions By: Ratel Consulting | Published on July 19, 2023

Guide to Investing in the EV Battery Supply Chain

Contributions By: Ratel Consulting | Published on June 21, 2023

|

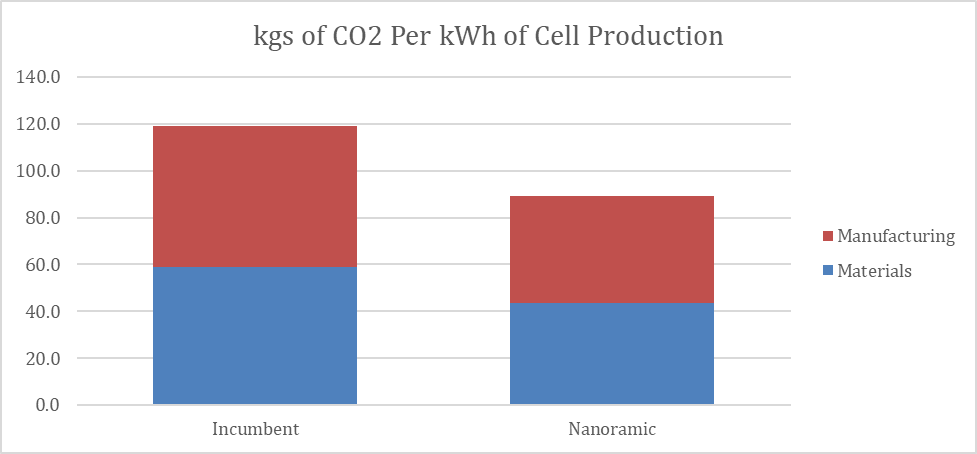

Green Batteries: Lowering the Energy Storage Manufacturing Carbon Footprint

By: Charlie Parker | Published on February 16, 2023

|

The Battery Report 2022

Co-authored By: Charlie Parker | Published on January 15, 2023

This report summarizes the most significant developments in the battery industry. Crowd-sourced from top industry and academia experts, this report seeks to provide a comprehensive and accessible overview of the latest battery research, policy, and business landscape.

|

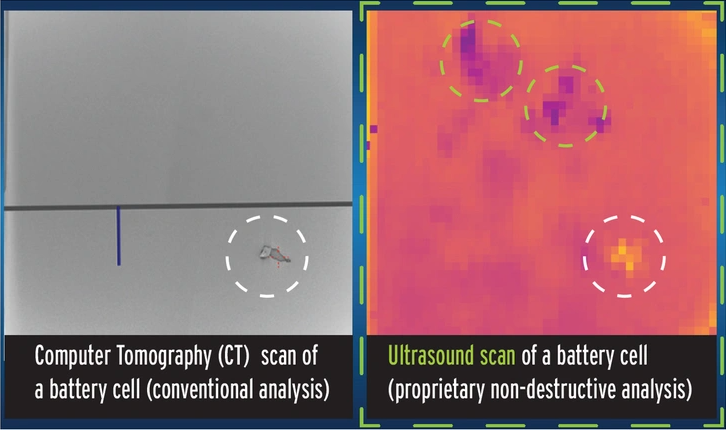

Ultrasound Inspection Optimizes EV Battery Manufacturing

By: Charlie Parker | Published on November 16, 2022

|

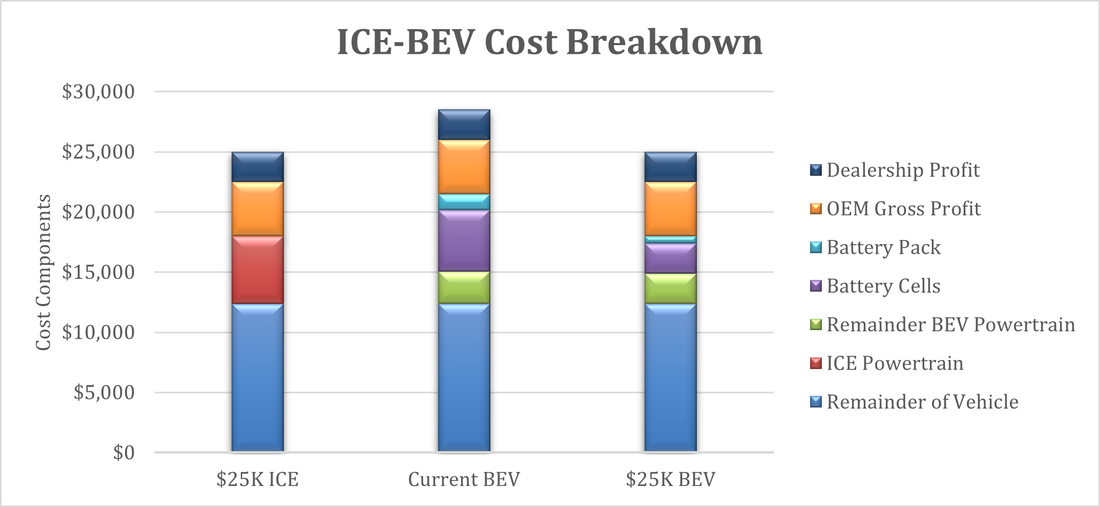

The $25,000 Electric Vehicle: How OEMs Achieve Mass Market Success in the EU and USA

By: Charlie Parker | Published on June 1, 2022

|

Powering the Drive to Zero: Unlocking Public and Private Capital for the UK Battery Sector

Contributions By: Ratel Consulting | Published on May 10, 2022

|

Electrode Manufacturing: Comparative Analysis of Wet & Dry Production Technologies

By: Charlie Parker | Published on March 30, 2022

|

A Tale of Two Chemistries: Battery Manufacturer’s Strategies for Winning both NCx and LFP Markets

By: Charlie Parker | Published on March 26, 2022

|

The Battery Report 2021

Co-authored By: Charlie Parker | Published on January 8, 2022

This report captures the most interesting developments in the industry in 2021. It intends to serve as a comprehensive and accessible guide to battery research, industry, talent, policy, and predictions and foster conversations on the state of batteries and their trajectory for the future.

|

Road To Zero: Unlocking Public and Private Capital To Decarbonise Road Transport

Contributions By: Ratel Consulting | Published on November 10, 2021

|

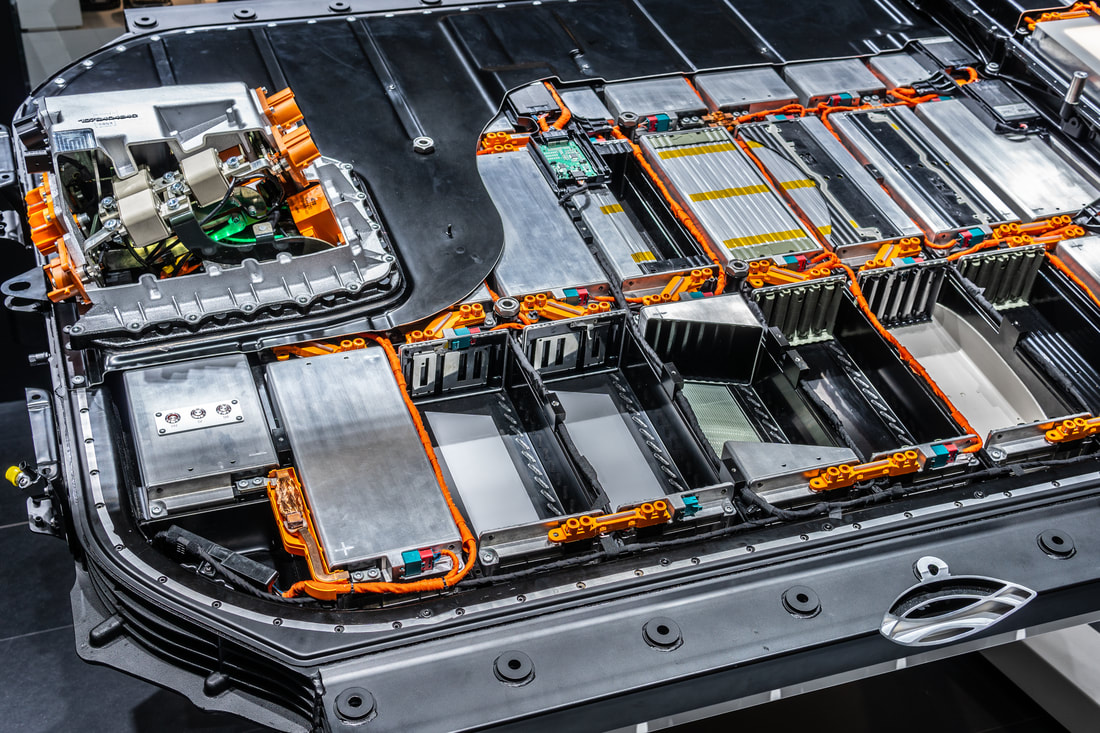

Thinking Outside of the Cell: How Battery Adjacent Technologies Can Catalyze Mass EV Adoption

By: Charlie Parker | Published on November 7, 2021

|

Gigascrap: The Path To Matching Li-ion Production & Recycling In Europe

By: Charlie Parker | Published on March 27, 2021

|